Finance professors and students at Stanislaus State recently shared financial advice to help students manage their budgeting by investing, saving and tracking finances.

As gas prices and other expenses rise, budgeting may become a necessity for students to make mature financial decisions. Mobile apps such as Mint and Nerd Wallet are available to help keep track of daily expenses. There is also an option to set maximum spending limits under different categories like gas, food, shopping and bills. Individuals also have the option to create their own categories.

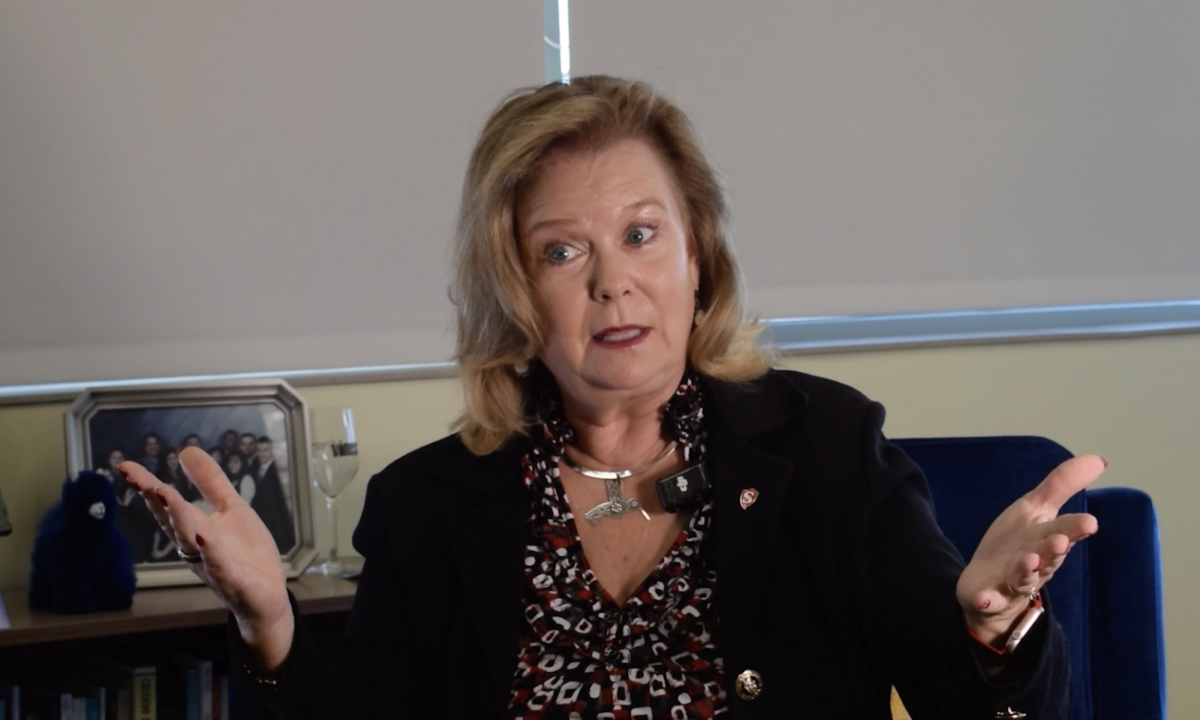

Finance professor Yili Lian shared practical advice that students can practice each month. She said budgeting is critical and recording your expenses and revenue can help you to analyze your budget at the end of each month to determine if there are any unnecessary expenditures.

“Keep your account balanced, try to save some money each month and invest it in funds or stocks,” she said, adding that the best retirement account for young students is ROTH Individual Retirement Account (IRA).

She also said that a 20-year-old student who compounds money at 6 percent per year and invests $100 each month, would have $199,149 at age 60, while a student starting with the same plan at age 30 would only have $100,451 at age 60.

“There is huge difference if you start earlier,” Lian said. “This is the magic of compounding.”

Some examples of popular apps that are relative to investing are Robinhood, Fidelity Investments, and Coinbase. Not only do they offer investing, but they also have options to open a retirement fund, such as ROTH IRA.

One thing to keep in mind is that everyone is in a different point in their life.

George Odisho, a financial analyst at Kaiser Permanente and finance professor at Stan State shared his experience with saving and investing. He started saving for retirement at 22 and never looked back and is in a much better financial position today than he would be otherwise.

“I see friends struggling to purchase their first home and realizing they haven’t saved enough. I see coworkers ready to retire and realizing there is no way they can be comfortable on social security alone,” he said. “Be ahead of the game.”

Odisho added that there is always a balance to saving, and you should prioritize your present as well as your future.

“You don’t have to skip every fancy meal, but you shouldn’t be dropping financial aid money on a table in Vegas either,” he said. “There is a balance. After all, money is a tool used to achieve your dreams, not a detriment to your life. Invest in your future now, but please don’t sacrifice the present.”

With budgeting, there will always be sacrifices towards certain areas of spending, however, there can always be accommodations. Like Odisho mentioned, starting young can be beneficial in the long-run.

Kimberly Ortiz-Castillo (senior, Health Science) said that most college students don’t really understand the meaning of money and once they are offered grants, FAFSA and loans, it seems like you are overflowing with money.

“The reality is that if you don’t budget and spend it wisely on necessities, this money won’t last you very long,” she said. “My advice is to know how much money you will need for your necessities. Don’t accept all the loans just because it’s money offered, you need to pay this back and some have interest on them.”

Categories:

Finance Professors and Students Share Tips and Tricks for Financial Budgeting

Alexia Garcia

•

March 30, 2022

0

Donate to Signal

Your donation will support the student journalists of California State University, Stanislaus. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover