When asked about the current interest rates on their student loans, most college students will answer with a blank stare. Upon enrolling in college, university students are forced to face the stage of responsibility widely referred to as “adulting.”

A major facet of “adulting” involves major financial decisions. While many students rely on their own better judgment and guesswork to make these decisions, California State University, Stanislaus (Stan State), offers resources to assist in this ease of passage from adolescence to adulthood.

A major financial decision with lasting implications for college students is their choice of housing.

“I started out living in a double housing unit (with two students in a room) and then because of maintenance issues and the fact that it cost too much, I moved into a triple (unit with three students),” Chloe Boswell-Dondorf (freshman, Communication Studies) said.

Student Kim Fischer (junior, Communication Studies) similarly made her housing decisions based on finance. She opted to live off campus in Turlock to suit her preference of a quiet place to study, while allowing her to have more price options than those presented by on-campus living. With the multitude of financial options in every decision, the decision-making process can be difficult and overwhelming.

Fischer was qualified to make this financial decision, however, because of her access to financial education before entering college.

“I was homeschooled,” Fischer said. “Since I was young, my parents always thought it was relevant to teach my brother and me–to use the popular term–to ‘adult’ and to complete the financial responsibilities adults are faced with. That definitely helped me.”

Unlike Fischer, most California high school students are not required to complete a course in financial education or business as a prerequisite to graduation. The California Department of Education’s minimum high school graduation requirements focus upon English, Math, Social Studies, Science, Visual and Performing Arts, Foreign Language and Physical Education curriculum.

Without this requirement, students are left to learn about how to manage their finances through their own experience. Even Fischer conceded to using Internet articles and the occasional Google search to answer her financial queries.

Dr. Gokce Soydemir, professor of finance at Stan State, noted his own lack of financial education as a university student which led to learning from his own mistakes with car loans and saving money. The professor commented that financial literacy is a learning process and education is the best tool available to avoid making financial mistakes.

“I had an interest in economics in high school, but had no formal financial education,” Soydemir said.

Fortunately for students, Stan State offers financial education programs and workshops. The Financial Aid and Scholarship Office’s February workshop about investments marks a step towards promoting financial literacy on campus. The investment workshop, hosted by accounting professor Arbella Solhkhah, discussed ways for students to stabilize their finances before investing by saving money, starting a neutral fund and buying stocks.

Dr. Soydemir granted additional advice for students seeking financial assistance and future stability. This advice includes saving for retirement from an early age, maintaining long-term discipline with stock market investments and staying away from credit card debt.

He advises students to begin saving $250 every month starting from when you are 25, with 4% interest, and you will save $100,000 in total in 30 years for your retirement. If students begin to save after the age of 25, they will have to contribute a larger sum or money monthly to obtain the same level of financial security as those saving since 25.

Dr. Soydemir also commented upon possessing long-term discipline when investing in the stock market. The market will go up and down, often times more down than you would like, but he stressed the importance of keeping the money in the market in order to reap substantial financial gain. If your money is invested in stable stocks, such as Microsoft and Amazon, the discipline to leave the money untouched will benefit in the long run.

He also advises students to “stay away from credit card debt,” despite the large amount of credit card offers aimed at students. Student loans have much lower interest rates than credit card loans and will be simpler to pay off, he stated.

The Financial Aid Office will host workshops about understanding and repaying student loans on 30 and Thursday April 20. Students interested in attending should contact the Financial Aid Office. Students can also access Stan State’s Financial Aid and Scholarship Office and Financial and Support Services Gateway resource online for additional assistance about financial questions.

Categories:

The importance of understanding financial literacy

by Gabriella Germann

•

April 18, 2017

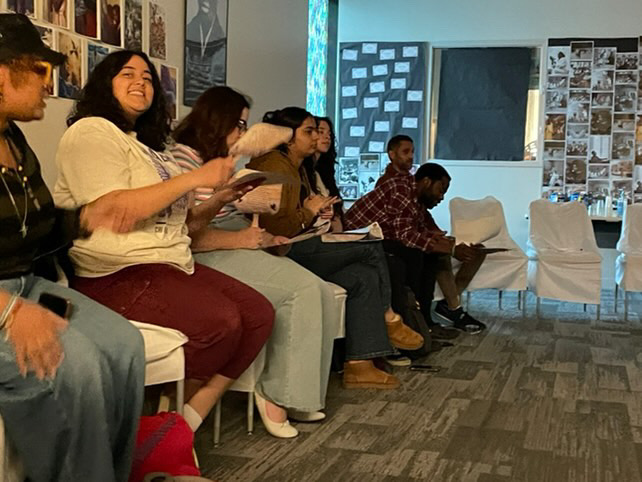

A financial administrator assists a student with her financial questions. (Photo Courtesy of Gabriella Germann)

0

Donate to Signal

Your donation will support the student journalists of California State University, Stanislaus. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover