This is the first in a series on sustainability issues at Stan State.

In early October, the California State University system announced its plan to join a number of other colleges and universities to help decrease dependency on fossil fuels. In a statement, CSU Chancellor Joseph I. Castro said that the university will not pursue any future investments in fossil fuels in the systems three investment portfolios: Systemwide Investment Fund Trust (SWIFT), Intermediate Duration Portfolio (IDP) and Total Return Portfolio (TRP).

The October 6 announcement came after Castro tasked the CSU’s Investment Advisory Committee (IAC) to review the university’s investments to ensure alignment between their fiduciary responsibility and its commitment to sustainability, according to a statement.

“Consistent with our values, it is an appropriate time to start to transition away from these types of investments, both to further demonstrate our commitment to a sustainable CSU, but also to ensure strong future returns on the funds invested by the university,” Castro said.

Following a May 2021 meeting, the IAC shared its recommendations with Chancellor Castro and he agreed to adopt them, tasking his staff with implementation. The IAC’s recommendations include:

- Liquidating fossil fuel-related bonds held in SWIFT as soon as reasonable and restrict future fossil fuel investments for that same portfolio and the IDP.

- Transition out of the TRP’s direct energy mutual fund and into other non-fossil fuel mutual funds.

- Work as appropriate and feasible to further reduce fossil fuel exposures in the TRP, which due to legislative restrictions is limited to mutual funds.

- Allow CSU investment managers discretion to continue to invest in businesses that are successfully transitioning to sustainable green business models.

The CSU’s decision follows a similar one made by the UC system in May of 2020 when it was announced they had divested entirely from fossil fuels in favor of renewable energy interests. More than 195 universities across the country so far have committed to do the same.

Stanislaus Exploring Options

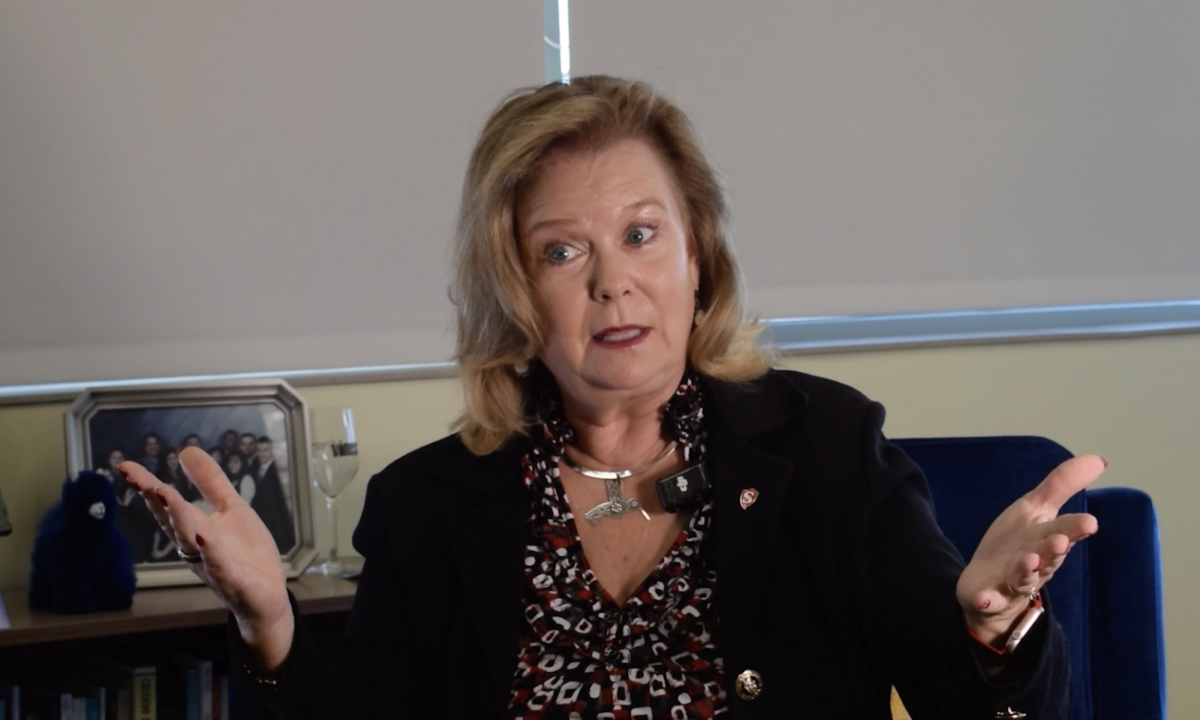

While the chancellor’s announcement deals with the system wide investment portfolio, each university is in charge of its own private portfolios. Stan State’s endowment portfolio is a pool of investments that have been accumulated over several decades from private donations from alumni and other supporters of the university, according to Stanislaus State President, Ellen Junn.

It’s a long-term investment strategy designed to provide a return that supports a regular spending distribution to support scholarships and programs, she explained.

“This strategy is in place so that a donation given today has the same buying power 100-plus years from now as it does today,” Junn said. “This concept of preserving the initial donation while accounting for spending and inflation is central to the concept of sustainability.”

One of the most important factors that the investment committee is evaluating is how to make the biggest positive impact while continuing to meet the Foundation’s investment objectives, Junn said.

Auxiliaries such as the Stan State Foundation, an independently operated 501(c)(3) organization which supports the university and campus but is a separate legal entity, cannot be obligated to adopt the recommendations of the CSU Investment Advisory Committee, but is free to adopt an investment strategy that best supports their specific missions.

Several CSU’s have already announced they will divest their individual portfolios, including San Francisco State, Chico State, and Humboldt State.

The Stan State Foundation began doing its own investigation several months ago as to how moving in the direction of divestment would affect their investments, Junn said.

“There are many ways to address sustainable investing and divestment is only one potential solution,” she said. “The Foundation is committed to long-term sustainability and has pledged to continue its fiduciary due-diligence to ensure that the Foundation’s goals and Stan State’s commitment to sustainability are met.”

Data from their research has already shown that divestment might actually increase revenue in some cases, Junn said.

“More and more companies are understanding that to invest in more green technologies and elsewhere actually has positive impact on revenue from their endowments,” she said.

Additional mobilizing factors on this and other sustainability issues include campus organizations like the Council for Sustainable Futures (CSF) committee and the Eco Warriors, which rally students to raise awareness for conservation and sustainability issues.

“We recognize that we have this very vital role as an institution of higher learning in helping students understand the critical role of addressing sustainability and to also mobilize students who are interested,” Junn said.

Student Momentum Increasing

Eco Warriors has been a part of the movement to encourage the divestment for some time, according to President Destiny Suarez (junior, Political Science).

“Eco Warriors has known and supported the fossil fuel (divestment) movement since the beginning,” she said.

The Eco Warriors were first approached about nine months ago by Divest the CSU, an advocacy group started by Cal Poly San Luis Obispo students hoping to to encourage the CSU’s to divest. But the rallying process had some challenges initially, as students were still solely online, Suarez explained. She said that social media played a key role, by driving informational and climate campaigns, and keeping students informed and up to date on the process.

“Fossil fuels are one of the major drivers of climate change,” she said. “I do not think people realize that their health is at major stake with the number of dangerous pollutants that are being released into the air because of fossil fuels.”

Suarez added that fossil fuel companies also cause water pollution and contribute to environmental injustices.

“Entirely, this general issue shouldn’t be a political situation, however, a concern over our health,” she said.

While Suarez said the chancellor’s statement to divest from fossil fuels is a great starting point for the CSU system, she would like to see follow-up results.

“I and the Eco Warriors group applaud everyone who worked hard on getting to this point and are eager to see further progress towards this goal,” she said. “We all have a future to look forward to.”

Divest the CSU is hoping to build on the momentum from October’s announcement by the chancellor and continue reaching out to other CSU’s, according to Assata Golash, Committee Coordinator with the group.

“We are hoping to expand our network now to get more campuses involved,” Golash said.

One of the groups co-leaders, Heath Hooper, said he believes the chancellor’s decision signals greater possibilities for divestment at individual campuses.

“CSU system-wide divestment significantly strengthens our individual campus campaigns, by giving us further precedent in discussions at our universities,” Hooper said in a press release after the chancellor’s announcement.

“Our coalition is encouraged by seeing our dedication pay off in a concrete way and we will use this feeling in our push forward.”

Golash added that Divest the CSU will host a number of trainings in November to get more students at more campuses involved.