How to Manage Your Student Loans

As the promise from Democratic Presidential Candidates to cancel student debt dangles in front of millions of students with federal loans, being able to understand and manage your student loans has never been more important.

According to the U.S Department of Education, 37% of Stan State undergraduate students receive federal loans. Fabian Hernandez (senior, History) is one of those students. He says that he took his loans out “…without knowing all the necessary information.” Being able to understand and manage your loans will not only save you time, but it will also save you money.

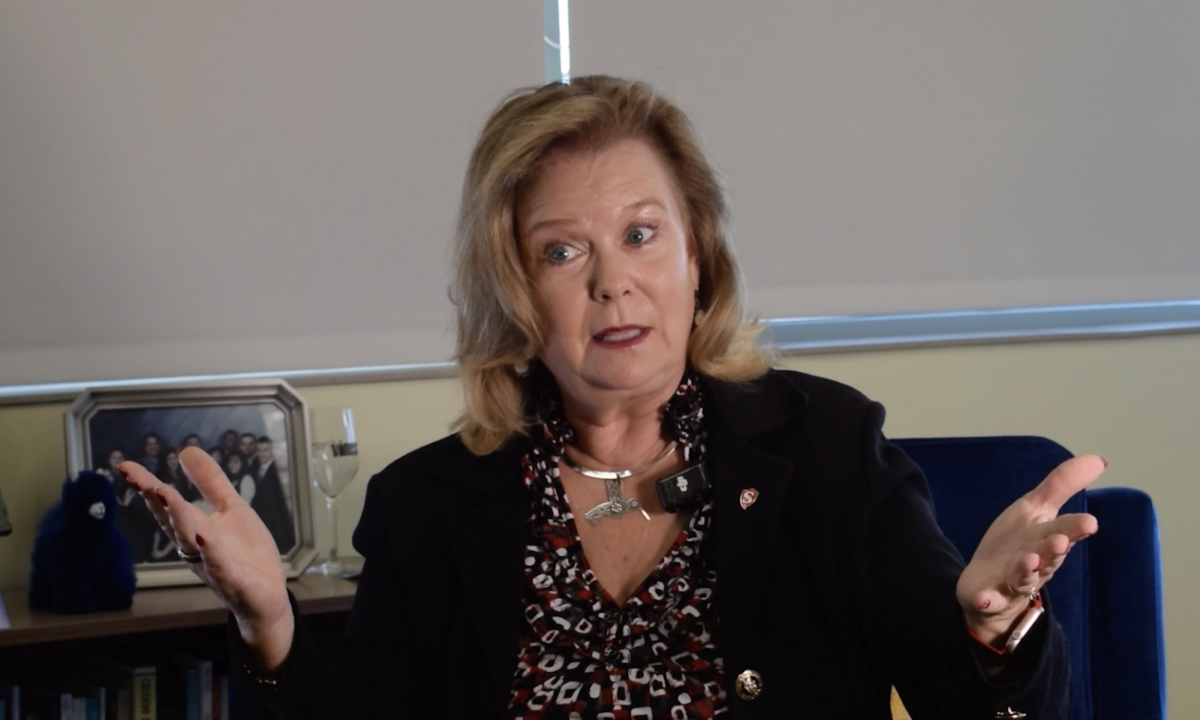

When it comes to loans, Financial Aid Advisor and Financial Wellness Program Coordinator, Landy Gonzales-Hernandez, encourages students to never “…borrow more than you need.” Borrowing more in loans than you initially need can cause students to pay back more than they should have to.

Differences in Student Loans & Interest Rates

Before being able to manage your student loans, students need to be aware of the different loan types and the interest that accumulates with both. Marina Rivera (junior, Sociology) is aware of the different loan types, but does not “really understand what the differences between subsidized or unsubsidized” are.

According to Gonzales-Hernandez, understanding the difference in loan types “…will actually save [students] some money in the long run.” It is important to understand the differences because both loan types (subsidized and unsubsidized) have unique interest rates that accrues over time.

For instance, in a subsidized loan the interest does not accumulate while in school and up to 6 months after graduation. In an unsubsidized loan, interest accumulates every day. Knowing this will help students when it comes to repaying loans.

Repayment Plans

Some students are not aware of the types of loan repayment plans offered. Rajneil Maharaj (senior, Business) states that he did not know about the different types of repayment plans.

There is a standard repayment plan “…that everybody gets placed on,” says Gonzales-Hernandez.

However, it is important to note that if students are not able to afford the standard repayment plan, there are other options, such as a few income-driven plans. According to Gonzales-Hernandez, these income-driven repayment plans depend on how much students earn. The loan servicer will simply take a percentage of the students income. There are a handful of options that are available to students. This is why it is important for students to be in contact with their loan provider to view their options and decide what works best for them.

Impact on Students

Student loans can have a huge impact on your life, whether it is positive or negative. Belinda Martinez (junior, Psychology) says that student loans have definitely impacted her life because, “it has allowed me to enroll in my fall semester.”

A lot of students rely on loans to put themselves through college. Georgina Salgado (senior, Ethics Studies) says that taking out student loans can be “…stressful and overwhelming…” She also believes that she “…wouldn’t be here without them.”

Taking student loans out may seem daunting and overwhelming to some, which is why it is important to understand them and know how to manage them.

Tips from Financial Aid Office

Gonzales- Hernandez encourages students to start paying their loans while in school and “… to [stay] away from those predator companies that are just targeting students who don’t necessarily know what the repayment options are and that there is help out there for free.” Take advantage of the resources available to you on campus.

If a student has any questions about their student loans, they can always make an appointment and talk to Ms. Gonzales- Hernandez or one of her mentors.