“I understand that Financial Aid can be scary and confusing, therefore, I want you to know that we, as a team, are here to help and that you are not alone. If you need help understanding how to fill out a document, questions when filling out the FAFSA or CADAA applications, or understanding the award letter, please do not hesitate to reach out! But in the meantime, I hope this series, Financial Aid and the Money Maze, gives you the opportunity to find out about the services we offer, the ways you can contact us, and, most importantly, that we are here for you.”

~ Landy Gonzalez-Hernandez, Interim. Assistant Director for the Financial Aid and Scholarship Office (FASO)

This is part 3 of a 4 part series

For many students, holds are one of the most difficult aspects of financial aid to master, mostly because of the fact that there are so many. Holds affect almost every aspect of financial aid, scholarships and even registration, so it is extremely important for students to know what is expected of them.

“All the holds are displayed on the MyStanState portal–that’s number one,” said Delfin Guillory, manager for the Stan StateFinancial Services Department. “When you click on the hold, any hold, it will tell you what type of hold it is and tell you the department to contact.”

There are many different holds that can be placed upon a student’s account, but some of the most common include ones relating to an unpaid balance.

“The Students Financials Department is responsible for placing the hold on the student’s account because they owe money,” Guillory said.

Students can prepare for these holds by knowing when they come out.

“Right before registration notices go out for the next term, we place holds for any past due debt, such as fees they have not paid, or an over–award from the Financial Aid Office,” Guillory explained.

These holds can prevent you from receiving financial aid, so be sure to pay any outstanding balances to free up your financial aid for the next term.

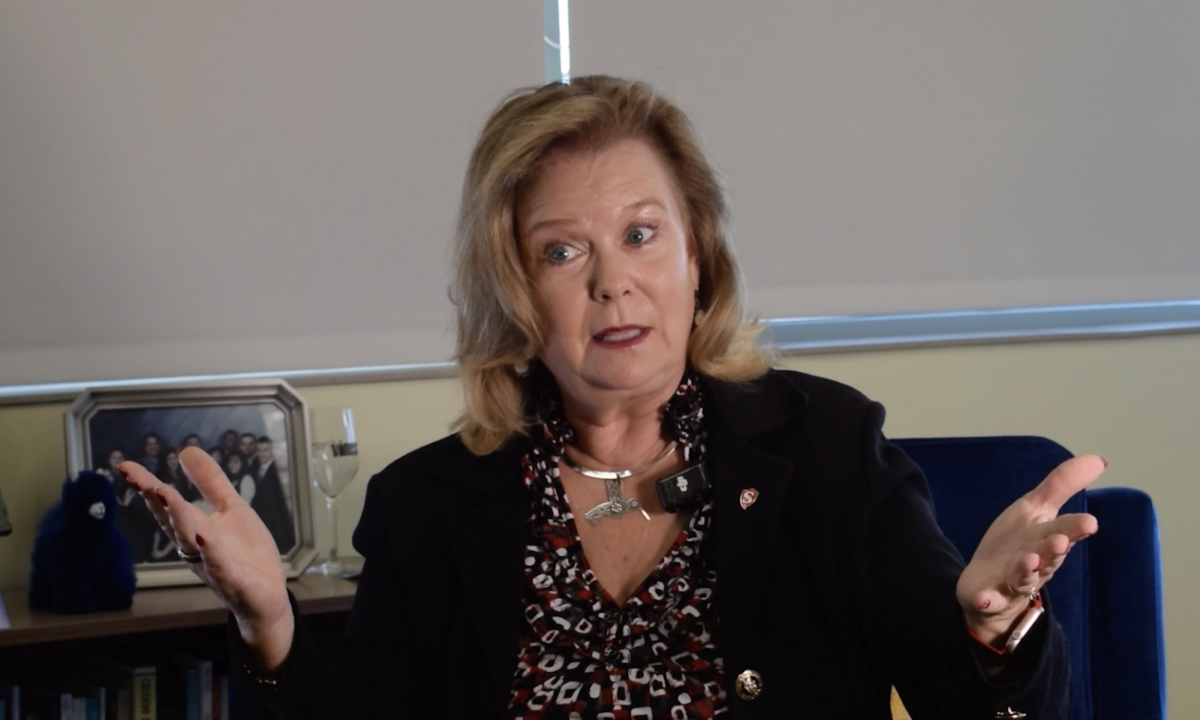

Both Landy Gonzalez-Hernandez, Assistant Director of the Financial Aid Office and Guillory recommend that students check their accounts on a regular basis to ensure they do not have any holds that will affect their ability to register for classes or receive their financial aid. Guillory explained that the Financial Aid Office and the Students Financial Services department always send communication to students about any past due balance that they have.

They also send out monthly notices and statements of a student’s account, which has information on where to go to check your student portal for any debt you may owe to the university as well as handing out this information at New Student Orientation, in the form of a pamphlet. There is even a video located here which offers step-by-step instructions for how to check your account.

According to Gonzalez-Hernandez the Satisfactory Academic Progress hold is the one that most students have difficulty with because, “If you stop meeting SAP, you stop receiving financial aid.”

This particular hold is placed on a student account on an annual basis, while Financial Aid determines if the student has met Satisfactory Academic Progress (SAP), a requirement for continued eligibility for financial aid. Sometimes, students can struggle with SAP, since financial aid cannot be disbursed until SAP is run on a student, which adds additional stress to a student worrying about keeping financial aid and doing well in classes.

Most students can address any holds on their account without delay. Unfortunately, the Satisfactory Academic Progress hold isn’t so simple. For this hold, the student is relatively powerless to do anything about it, and can only wait for the process to be completed, which can sometimes take a few weeks, if the Financial Aid Office is extra busy.

Satisfactory Academic Progress consists of four main parts:

-

Pace of progression: passing 70% or more of attempted classes/units

-

An acceptable grade point average, as determined by the university’s graduation requirements.

-

Unit limits determined by the maximum time needed to complete a degree

-

Miscellaneous requirements, such as past problems meeting other areas of SAP

The SAP hold remains on the student account until financial aid clears the student for passing SAP. Once this happens, the student is authorized to receive financial aid for the next funding period and register for classes. However, an SAP hold can be reinstated on a student account at any time during the academic year if the Financial Aid Office believes that a Satisfactory Academic Progress review is needed.

However, during the pandemic, SAP requirements were changed somewhat to accommodate the sudden change in teaching modality that occurred in the spring of 2020 as classes went from being in person to online.

“At the beginning of the pandemic, we were a little more flexible with students,” Gonzalez-Hernandez said.

“Even before the pandemic we were never that stringent. We always try to work with the students to help them, not stand in their way,” she added.

If a student is denied financial aid based on unsatisfactory academic progress, they can file an appeal by filling out a form located here.

For more information on Satisfactory Academic Progress, go to https://www.csustan.edu/financial-aid-scholarship/satisfactory-academic-progress

The Covid-19 pandemic also affected other areas of financial aid, especially the way that the Financial Aid Office offered assistance to students. During spring of 2020, most administration offices switched to providing services from at–home offices, a transition that was difficult for both students and the Financial Aid Office staff.

Gonzalez-Hernandez thinks all of them have done well, students and staff included. “We have an amazing staff, and they have been incredibly resilient and flexible though the whole pandemic.”

While she does not think that ways of doing things during the pandemic will last forever, she does believe that certain aspects of the transition will be integrated into financial aid on a permanent basis, such as the option of Zoom meetings for financial aid advising, which many students have utilized over the last year and a half.

The pandemic also impacted the Free Application for Federal Student Aid, or FAFSA. This year, “the FAFSA application for the 2022-2023 school year will be using 2020 tax returns when asking for financial information,” explained Christine Goodeill, a Financial Aid Advisor with the Financial Aid and Scholarship Office.

The Financial Aid Office also recommends that students submit their FAFSA application as soon as possible, so that if additional documentation is required, it can be added to the application and processed.

For help with these and other general questions, students can go to “Financial Aid Fridays,” a weekly workshop where a Financial Aid Advisor is there to answer your questions about general things, like what to do about holds, as well as dates and deadlines for submitting applications.

For any personal questions about the FAFSA or your Satisfactory Academic Progress, it’s best to use Stan State’s online scheduling form, which can be found on their website.

Financial Aid and The Money Maze covered a lot in this issue, but there is still a ways to go before we’re through. In the next and final issue, we will be discussing things like census date, other resources that financial aid students have access to, and the way all this aid interacts.