During a rally held at Hinde Auditorium on the campus of Sacramento State University last Wednesday, State Senator Noreen Evans (D-Santa Rosa) introduced a bill that would markedly boost state funding for higher education throughout the Golden State.

The bill, SB 1017, would levy a 9.5 percent severance tax on oil extracted within California, which is currently the only petroleum-producing state without one. The rate is in line with other states’ rates, which vary from 6.5 percent in North Dakota to 25 percent in Alaska.

Under the proposed legislation, the collected proceeds would go directly into an endowment, 50 percent of which would be split evenly amongst the CSUs, the University of California and California Community Colleges.

The other 50 percent would be split evenly between state parks and health and human services. Evans’ office estimates the bill would collect $2 billion annually.

“California remains the only oil-producing state in the nation that does not impose an oil extraction tax,” Evans told those in attendance at the rally.

“Meanwhile, our debts grow, our population increases and our services are strained while new revenues from our own natural resources earn $331 million a day for big oil companies. Not taxing oil extraction is simply fiscally unsound.”

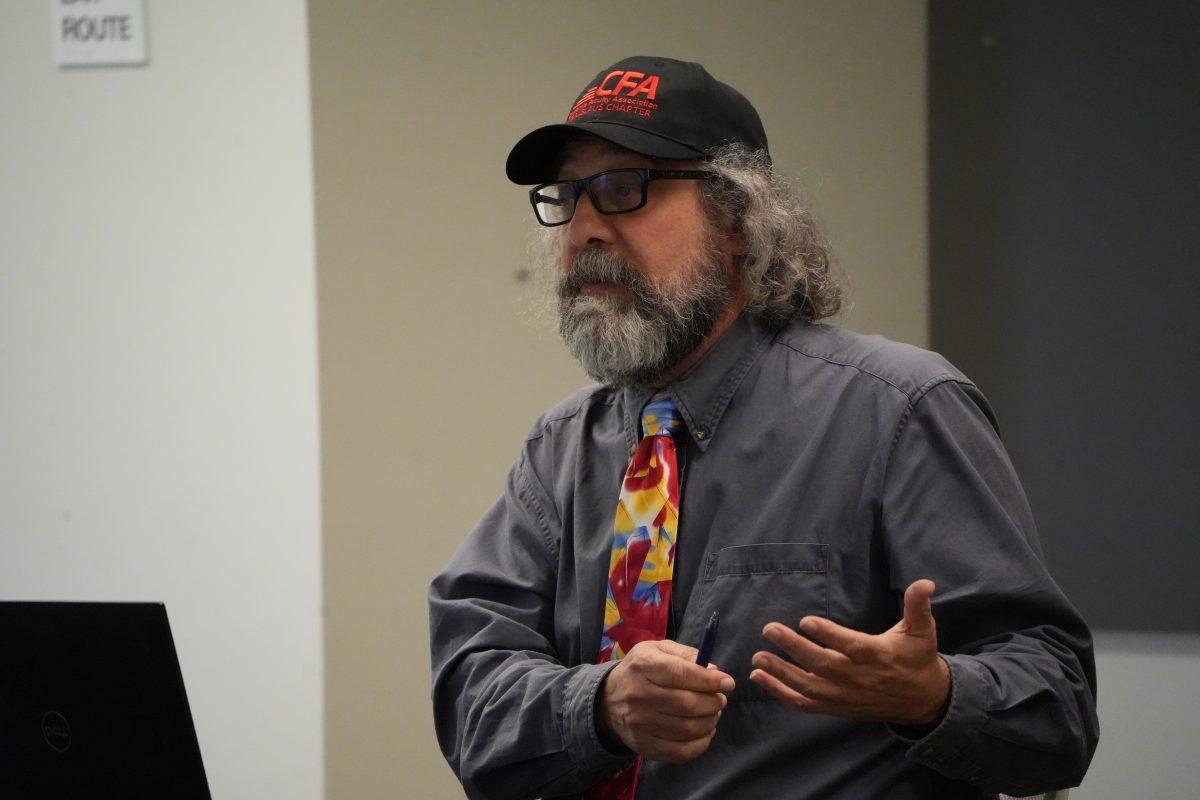

Though the bill enjoys strong support from organizations such as the CSU Faculty Association and various environmental and student groups, it is not without its detractors.

The petroleum industry and other groups, such as the California Chamber of Commerce and Californians Against Higher Taxes, have come out in strong opposition to the bill.

“We just raised California taxes by $7 billion a year for seven years,” California Chamber of Commerce Chief Executive Allan Zaremberg said in an online statement on the Chamber’s website.

“We now have a projected $5 billion surplus. To create a new tax on oil only extracted in California will drive up the price of California oil, which constitutes about 40 percent of the California gasoline market.”

Governor Brown also stands in opposition to the bill. He has pledged not to create any new taxes this year as he seeks re-election.

When the idea was brought up during his budget proposal conference in January, he replied, “I don’t think this is the year for new taxes.”

“Governor Brown has been very clear: now is the time for fiscal restraint and government efficiency,” Beth Miller, spokeswoman for Californians Against Higher Taxes, told the San Jose Mercury News.

“But Senator Evans clearly isn’t listening. Instead, she is focused on raising taxes on hard-working Californians and creating a huge, new, unaccountable government bureaucracy.”

This is not the first time Evans has proposed this bill. SB 241, drafted during last year’s legislative session, sought to institute the same tax. It failed to make it out of committee.

Some students saw this as welcoming news.

“I think it’s about time those big [oil] companies pay their fair share,” Katie Flores (senior, Art) said. “Plus, it might help cap this tuition from getting any higher.”

Though many shared Ms. Flores’ sentiments, some still remained skeptical.

“I just see it as another way to make everything more expensive,” Daphne Herrera (sophomore, undeclared) said.

“These things never work the way they’re supposed to.”

Categories:

Oil tax bill introduced at Sacramento State Rally

By Shawn Harkins

•

March 4, 2014

0

More to Discover