While students at Stan State are working hard to gain college credits, the financial aid and scholarship office want students to remember to maintain their own credit scores. Thus, the financial aid and scholarship office held the Understanding and Repairing your Credit Workshop.

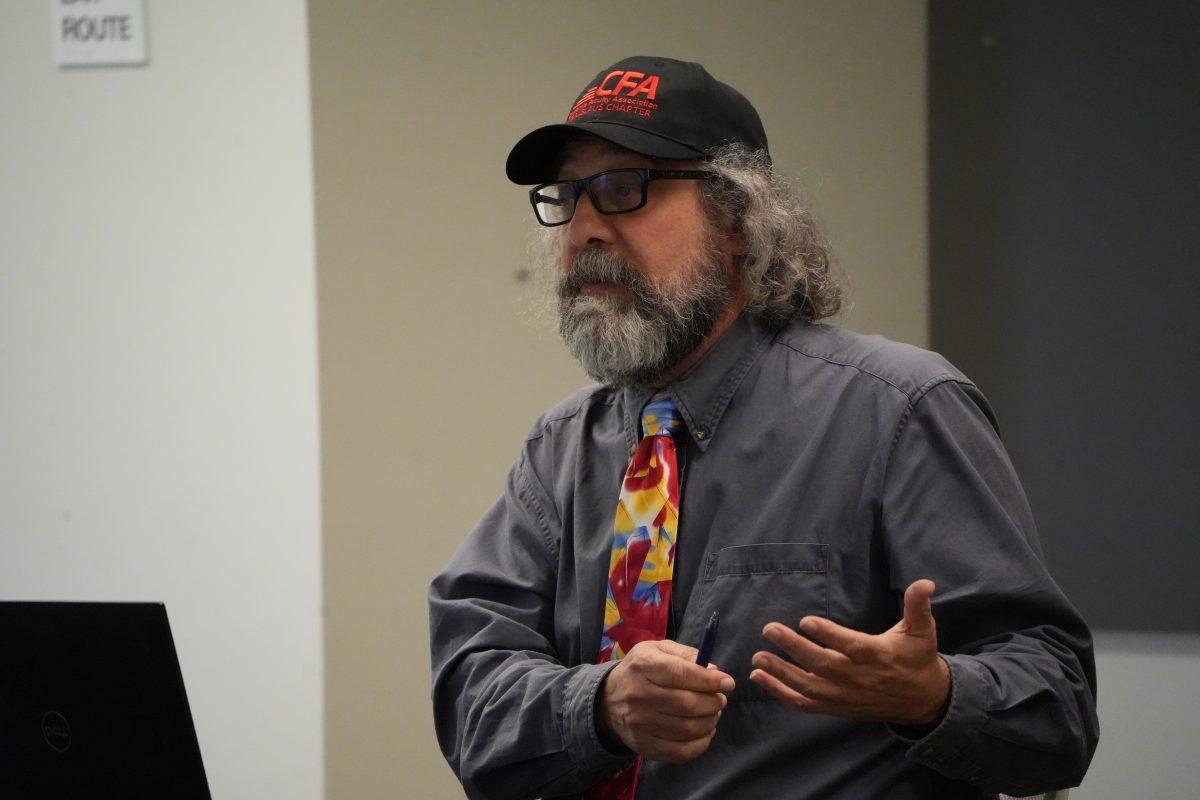

The university invited Nicholas Vollmer, a membership development officer from Golden 1 Credit Union, who provided tips for students to gain financial literacy.

Financial Aid Advisor Landy Gonzalez Hernandez explained the importance of holding this workshop.

“It is important for students to understand and get these life skills before they leave us, so we try to put in programming that will help us do that,” Gonzalez Hernandez said.

It is also important to maintain a good FICO score. FICO, originally Fair, Isaac, and Company, is a measurement of consumer credit risk for lenders. In other words, FICO scores helps lenders decide if they should lend money to consumers.

“Credit is borrowing with a term to pay something back. If we didn’t have credit, it would take a long time to save for items like cars and houses,” Vollmer said.

Some possible advantages to credit is rewards which can include cash back from using credit cards.

“One of my favorite things is the rewards. At Golden 1, our credit card pays three percent cash back. Anytime I use my credit card at a restaurant, the gas station, or the grocery I earn three percent. You already shop, so why not make some money with your money,” Vollmer said.

Your FICO score is made up of multiple components. 35 percent of your score is payment history, 30 percent is amounts owed, 15 percent is credit history, 10 percent is new credit and another 10 percent is credit types.

Another way that helps lenders make a credit decision is your debt to income ratio (DTI). To calculate your DTI, add up your monthly debt and divide this number by your gross monthly income. A DTI below 45 percent is favored by most lenders.

Vollmer explained that credit is a good thing to have, but it is also important to make your payments on time to maintain your credit and prove your responsibility. It is also good to not completely rely on your credit cards.

Deanna Chan, (junior, Biology) attended the workshop and was able to learn new information about credit that day.

“It was very informative,” Chan said. “I learned more things than I intended to. I will definitely look into getting a credit card because I only have one and I rely on it a lot.”

Vollmer is passionate about sharing his knowledge about credit with others. Prior to banking, Vollmer worked as a door-to-door salesman, a sales counselor for 24-hour fitness, and a handyman at Home Depot. He then started working in banking at Tri Counties Bank in Elk Grove, CA.

He later moved on to work at Golden 1 Credit Union as a branch manager. Vollmer wanted to work in a company that was local and worked hard to gain his current position.

“I applied online, but I also reached out to the decision makers. I physically go in and introduce myself,” Vollmer said. “I went to several different branches looking for the market area managers, and I went to the corporate office looking for the human resource decision makers.”

He wanted students to know that it is imperative to build your credit, be responsible and prove you are a responsible person. One possible way to keep track of your credit is by using a free credit app such as Credit karma.

Vollmer will return to Stan State this month on the 28 in South Dining at 5 p.m. for another workshop to discuss auto buying. For more information on upcoming workshops for financial literacy, click here. For more information and resources regarding building credit visit Credit Card Insider.

This article has been updated to include a link to the Credit Card Insider’s webpage.

Categories:

College credits students with information on financial literacy

Nicole Dunlap

•

February 20, 2018

Students listening to the Understanding and Repairing your Credit Workshop hosted by Nicholas Vollmer from Golden 1 Credit Union. (Signal Photo/ Nicole Dunlap)

0

More to Discover